EQUITIES COMMENT – “MOST DIVIDEND STOCKS OUT OF THE DOGHOUSE”

- Patricia A. Stewart | CFA

- Oct 7, 2024

- 6 min read

The third quarter of 2024 saw most “dividend” stocks stage a major recovery from the depressed levels of the last twelve months. The chart below shows a “proxy” for both Canadian and U.S. dividend stocks over the past two years. You can see the previous highs were reached in early 2023 but as central banks continued raising rates, downward pressure on dividend stocks increased. The lows were reached last fall. Since the beginning of July, there has been a substantial increase in dividend stocks and they are now making new all time highs.

Rate cuts by the Bank of Canada and U.S. Federal Reserve are benefitting dividend stocks. Because interest rates have come down, the yields on dividend stocks look more attractive to investors. As a result, funds are being allocated to dividend stocks rather than bonds and GIC’s .

During the third quarter, Canadian stocks outperformed U.S. stocks with a gain of 10.5% for the TSX Composite compared to 4.5% in Canadian dollar terms for the S&P 500. The annual returns are impressive: TSX Composite +26.7% and S&P 500 +36.3%.

Now let’s look at the sector returns year to date. Many sectors have posted returns over 10% and only one is negative—Canadian Communications. This is due to a series of adverse regulatory actions by the federal government that are designed to increase competition and reduce the cost of cell phone and internet services for Canadians. (They have also been hugely beneficial for Quebecor-more on this to follow.) Technology remained the top performing sector in the U.S. followed closely by Communications (Google and META) and Utilities. Technology and Communications have been benefitting from the growth in Artificial Intelligence (AI) applications while Utilities were up because they will be supplying the vast amounts of power required for AI computing. Among the TSX sectors, Materials had the best return due to a strong rally in gold. Gold has benefitted from central bank buying as some countries reduce their reliance on U.S. dollars in their reserves. As well, investment

demand has picked up given expectations for further rate cuts by the Federal Reserve. The next best performing sector on the TSX was Financials. Financials contain many stocks with low valuations and the growth outlook has improved with lower interest rates.

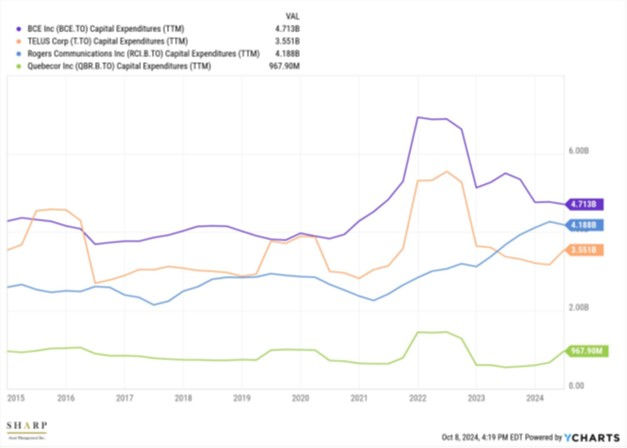

The graph above shows the share prices of the big 3 Communications stocks – BCE, Telus and Rogers – as well as Quebecor. BCE and Telus have been stalwart dividend stocks. You can see that BCE and Telus have the worst performance over the last two years, Both companies have invested billions of dollars to build fibre networks. The federal CRTC (Canadian Radio-Television and Telecommunications Commission) is now mandating that starting in February 2025, companies in Canada that own fibre networks must give competitors access to their networks for a fee. The CRTC will be determining the fee. This builds upon a ruling late in 2023 that temporarily required just Bell and Telus to provide competitors with access to their fibre networks only in Ontario and Quebec.

Looking back at the chart, you can see that Rogers has faired better than BCE and Telus. Rogers has very limited fibre exposure. As well, it is benefitting from economies of scale in its cable business after the merger with Shaw was approved by the federal government.

The best performing stock has been Quebecor. Again, thanks to the federal government, Rogers was forced to divest Shaw’s wireless operations and Quebecor was approved to buy them. Because it is smaller than the Big 3, it receives numerous benefits such as lower rates from the feds for spectrum purchases. Quebecor will be one of the biggest beneficiaries of the ruling to allow access to fibre networks given its operations are concentrated in Quebec and it cannot afford to build its own fibre network. It is interesting to note that the majority shareholder of Quebecor is Les Placements Peladeau which is 100% owned by Pierre Karl Peladeau. He is also the company’s President and Chief Executive Officer. In 2015, he was elected leader of the Parti Quebecois but resigned almost a year later. His role as owner of the province’s largest media company was perceived by many as a conflict of interest when he was in that position. Given the positive impact recent federal backed decisions have had on Quebecor, it was interesting to see the Bloq Quebecois come to Trudeau’s rescue in the recent non-confidence votes. This is a micro analysis of recent developments in the Canadian Communications industry. On a much broader level, these rulings will very likely have a negative impact on future investment in this country. Companies (and investors) will question the merits of spending billions of dollars on projects when the feds can arbitrarily prevent companies from reaching their profit objectives or even worse, recovering their cost of capital.

Our response to these developments is to continue holding BCE and Telus. The dividend yields are very competitive with the long term return on stocks and we do not anticipate dividend cuts. We will continue adding to our U.S. equity holdings and trimming back the Canadian equity positions. Many of the Canadian stocks we invest in have large U.S. operations where growth prospects are much better than in Canada. As well, the regulatory environment is less onerous.

We are going to leave our 2024 target for the S&P 500 at 5,700 but increase our target for the TSX to 24,000. The p/e multiple for the TSX has increased but remains very attractive. Earnings have been supported by the higher gold price. For U.S. stocks, the earnings outlook remains positive. While the valuation for the S&P 500 is above the five-year average, this has a lot to do with Technology related stocks that are experiencing very strong earnings growth. As long as p/e multiples do not decline and earnings do not fall short of estimates, stocks should rise further in 2025. Our targets are 25,200 for the TSX and 6,100 for the S&P 500.

Risks (upside and downside) to our forecast include:

Artificial Intelligence -Disappointing results from influential stocks such as NVIDIA could cause p/e multiples in the Technology sector to deflate. Because Technology makes up about 30% of the S&P 500, a reduction in valuation would have a negative impact on the overall index.

Economy - It has held up much better than expected to higher interest rates. Normally, rising interest rates have a lagged negative impact on economic activity. The probability of a recession in 2024 and 2025 is considered low by many investors. However, the recent uptick in unemployment rates could be a sign that growth is not as robust as believed. Should a recession occur, stock prices would likely decline due to both lower earnings and falling p/e multiples. On the other hand, continued strength in the economy would support earnings and stocks.

Inflation – This is a key factor influencing rate cuts. Inflation has been declining however, it remains above the central banks’ 2% inflation target on most measures. Higher wages and increased costs for housing/rent are boosting inflation while lower gasoline prices are disinflationary. Lack of progress in getting inflation down could cause bond yields to rise and delay rate cuts. Eventually, this could put downward pressure on stocks.

U.S. Election – The outcome is too close to call. Should Trump win and have a majority in Congress, his election agenda could provide a short term boost to the economy and stock market if he cuts taxes. On the other hand, raising tariffs would hurt economic growth and damage confidence worldwide. Kamilla ‘s proposed corporate tax increase presents a risk to the earnings outlook. Overall, both candidates are expected to run large fiscal deficits which will continue to boost economic growth.

Supply Chain Disruptions - The wars in Ukraine and Middle East have impacted trade and supply chains. This has put upward pressure on inflation. Continued attacks in the Red Sea have caused an increase in shipping costs due to higher insurance rates and longer shipping times. The risk of a wider Middle East war that could affect oil production and transportation would also be inflationary.

The performance of stocks in 2024 has been very rewarding for patient, long term investors, even those that prefer the safety and income from dividend stocks. We expect volatility to increase in the final quarter of 2024 as we draw closer to the U.S. presidential election. To have a correction over the next few months would not be a surprise given the gains in stocks to date. Looking out to 2025, we see further, albeit more modest, positive returns from both Canadian and U.S. stocks.

Comments